Now in Wisconsin

.png)

Personalized Lending + Advising

to Grow Your Business

At the Entrepreneur Fund, we pair small business loans of up to $750k with no-cost advising. Our team partners with you to customize a plan that works best for your business, not someone else’s. As a nonprofit lender, we prioritize your needs, your business, and your community.

There is no cost to get started. Not ready? We encourage you to join the EFund community by subscribing to our newsletter or schedule a complimentary discovery call with a member of our Wisconsin team.

Current Wisconsin Opportunities

Wisconsin Down Payment Assistance Grant Program

Eligible Wisconsin businesses can get up to $10,000 in grant funding when paired with a small business loan.

What is the Down Payment Assistance Grant Program? Let's say you're looking to purchase equipment for $15,000 to boost your production. Our Down Payment Assistance Grant offers a $1,500 grant towards this cost, and pairs it with a $13,500 low-interest loan, ensuring you have the $15,000 needed for this vital investment in your business's growth.

What can it be used for? Funds can be utilized for a variety of business purposes including down payment assistance on any loan project, leasehold improvements, equipment purchases, inventory or supplies, marketing, working capital, and technology.

Who is it for? The grant program aims to boost financial equity by helping diverse businesses in northern Wisconsin access necessary capital. It's especially for small businesses historically underbanked or denied funding. This program is supported by Wisconsin's Department of Administration and funded by the 2021 American Rescue Plan Act.

How do I access this grant program? Book a complimentary discovery call to learn more about this program and to confirm you eligibility.

Wisconsin Rural Equity Grant Program

Grants of up to $10,000 are open to established, diversely owned businesses for a range of expenses.

What is the Rural Equity Grant Program? The Wisconsin Rural Equity Grant program will award a total of 30-40 grants of up to $10,000 each through 2024 to established, diverse-owned businesses in 12 counties and seven Native nations that share geography with northern Wisconsin.

What can the funds be used for? Rural Equity Grant funds can be utilized for a variety of business purposes including leasehold improvements, equipment purchase, inventory and supplies, marketing efforts, working capital, technology upgrades, and down payment assistance on capital projects.

Who is it for? The funding is aimed at assisting small business owners who’ve experienced barriers to capital and who’ve been disproportionately impacted by the COVID-19 pandemic.

Why is it different? The funding is aimed at assisting small business owners inrural, northern Wisconsin who’ve experienced barriers to capital and who’vebeen disproportionately impacted by the COVID-19 pandemic. This initiative ispart of the Diverse Business Assistance Grant Program from the Wisconsin DOAand is powered by the American Rescue Plan Act (ARPA).

How do I apply? A second round of grant applications will open in Fall 2024.

Be Strategic: Grow Your Business

Maximize your potential by focusing on your business strategy, not just the day-to-day operations.

What is Be Strategic? The Be Strategic program provides a unique opportunity for local, non-competing businesses to work alongside one another to create a strategic business plan for growth, make meaningful connections, and improve their business within a supportive group setting.

Who is it for? Be Strategic is for growth-oriented business owners in northern Minnesota and Wisconsin. Ideal participants have been in business for a couple of years, are ready to take the next steps in growing their business and are willing to be held accountable to reach their goals.

Why is it different? The six-week interactive course is designed and facilitated by EFund advisors who have years of experience helping businesses grow. Participants work through various business topics, including defining their mission, vision, and core values, identifying trends in their industry, creating a marketing plan, and refining their 10-year target. By the end of the course, each business owner walks away with a strategic plan to help them achieve their growth goals.

How to apply? We will be offering many courses throughout our region in 2024. Join our newsletter below for course updates.

Profit Mastery

Maximize your profits and better understand you business financials.

What is Profit Mastery? The two-day workshop focuses on providing participants with the knowledge and skills necessary to help their business achieve financial success. Dig into your finances and learn alongside fellow business owners from a skilled local facilitator.

Who is it for? Profit Mastery is for business owners who want to become more confident and skilled in managing their financials and making financially sound decisions for their company. If you are ready to grow your financial management skills, this is for you.

Why is it different? Profit Mastery has an international reputation for providing unparalleled financial management and business planning education. The curriculum is owned by Business Resource Services and facilitated by EFund advisors.

How do I register? Please join our email list below for updates on upcoming Profit Mastery workshops in Wisconsin.

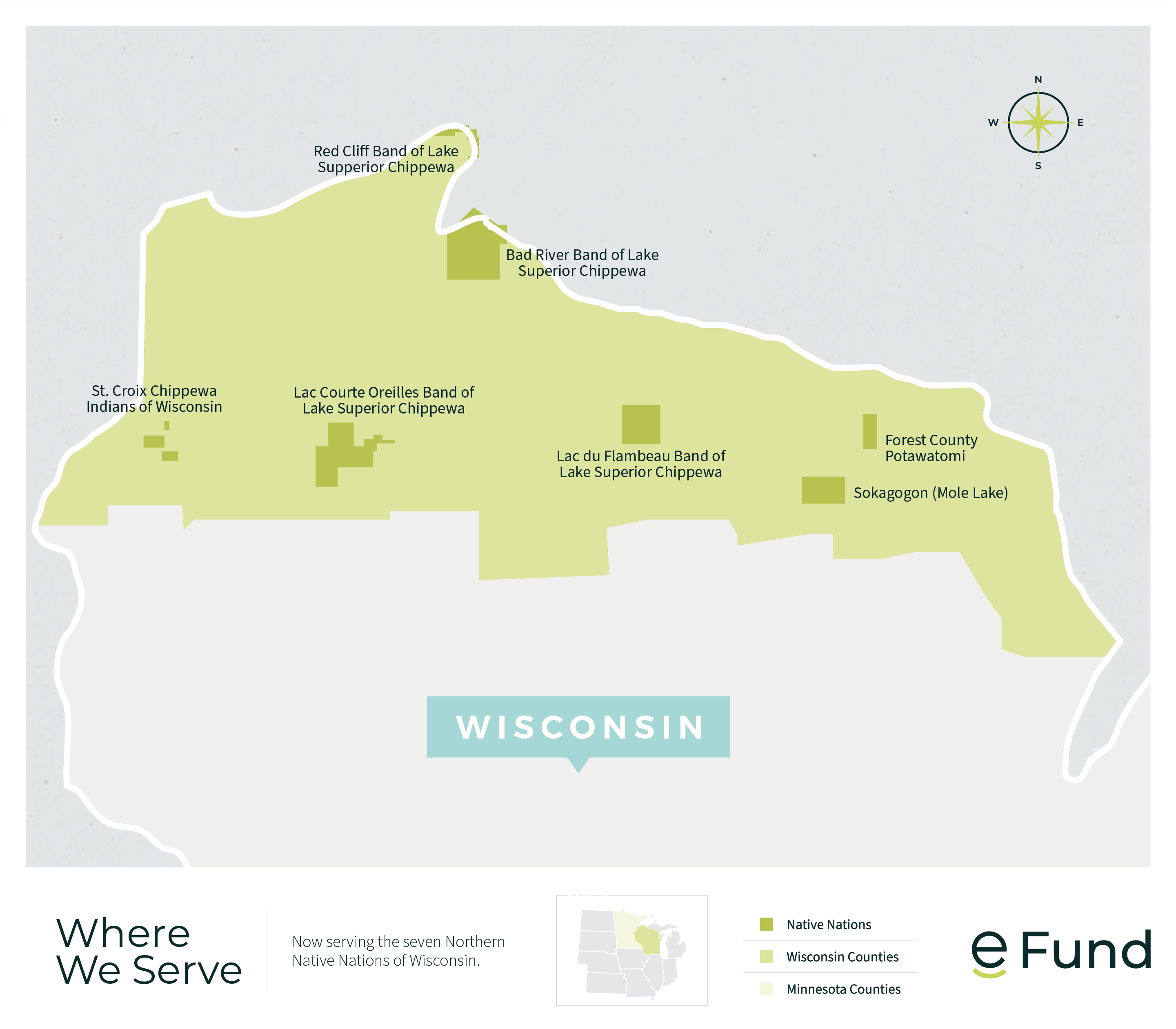

Our Wisconsin Region

We focus on serving entrepreneurs and businesses located in 13 counties and 7 Native nations that share geography with Wisconsin. Our advisors, loan officers and business developers live and work in the communities they serve, which helps them better understand and support the needs of small business owners in their community.

Our Service Region Includes:

Wisconsin Counties

NATIVE NATIONS